How Do Employyes Of A Public Company Make Money Through Equity

Disinterestedness is the unit of ownership of your company. It has 2 features: economics and command. Economic science is the financial do good when your business performs well. Control is the influence an equity owner has on the future of your company.

Generally speaking, companies grant equity to iii types of stakeholders: founders, employees, and investors. Stripe Atlas has written a guide on equity for founders; this one will focus on disinterestedness for employees.

This guide is nearly relevant for startup founders. Equity is a powerful tool to reward early employees for taking the chance of working with y'all (recruiting) and for motivating them on an ongoing ground (retention). Recruiting and retention are the two goals of employee equity and should e'er be top of mind when making a decision about an employee's equity.

By the end of this guide, you lot'll understand:

-

The definition of an equity program and how to determine its size

-

How to handle employee departures or terminations in your disinterestedness plan

-

The three goals of vesting—and how to build an equity programme to support them

-

Means to grant equity, and their advantages and disadvantages

-

The differences between ISOs and NSOs—and a mutual mistake to avoid

-

Recommendations from Caster, based off of helping thousands of companies manage their cap table and equity

Caster provides a top-rated cap table solution. Stripe is both a partner of and investor in Caster. Experts at Pulley contributed their expertise to this guide (see disclaimer), and Atlas users can access more customized guidance directly from Caster.

What is an disinterestedness plan?

An equity plan is a portion of your company that you plan to reserve for your employees. Before long after incorporation when the value of your company is yet low, you'll typically hope early employees a certain per centum of the company (e.g., 1%). Recollect of equity compensation in terms of how much equity you'll demand to offer to close a rent. The tricky part near hiring with equity compensation is that equity is a finite resource and you don't know which of your hires will end up being the best—and you want to utilise equity to advantage performance, not a resume.

Although every company is different, startups that are pre-funding or have raised their commencement priced round typically land at the post-obit benchmarks:

-

1-3% for cardinal executives (eastward.g., VP of sales or VP of product)

-

0.five-1% for early ICs in technical functions (design, engineering)

-

0-0.5% for early ICs in commercial roles (bizops, bizdev)

Without an disinterestedness plan to define how many total shares are reserved for employees, the number of shares that you owe an early employee will fluctuate:

-

Founder A: 4 million shares

-

Founder B: 4 million shares

-

Employee 1: 1% = ~eighty,000 shares

If you were to requite 1% to Employee ane, yous might think that you need to give lxxx,000 shares, calculated based on the founders' total—which until this hire, represented full ownership of the visitor. Merely that would brand the new total share count 8,080,000 and the employee would own slightly below i%. And with every new employee added, Employee i'southward buying percent would continue to autumn, which turns your 1% offering into a imitation promise.

Instead, if you institute a program and reserve 10% of your visitor for employees by and large, the math looks like this:

-

Founder A: iv.five meg shares

-

Founder B: 4.v million shares

-

Employees: 10% = 1 1000000 shares

Now, your company has a k total of ten one thousand thousand shares, and an employee disinterestedness pool of one million shares. If you give 100,000 shares to Employee 1, their ownership percentage—x% of the employee equity pool or 1% of the company—will not change with every new rent and you're able to stay true to the offer yous pitched them.

Every bit y'all're implementing an employee equity plan, at that place are ii major decisions to get right: the size of the programme and what happens when an employee leaves.

How large should my employee equity program be?

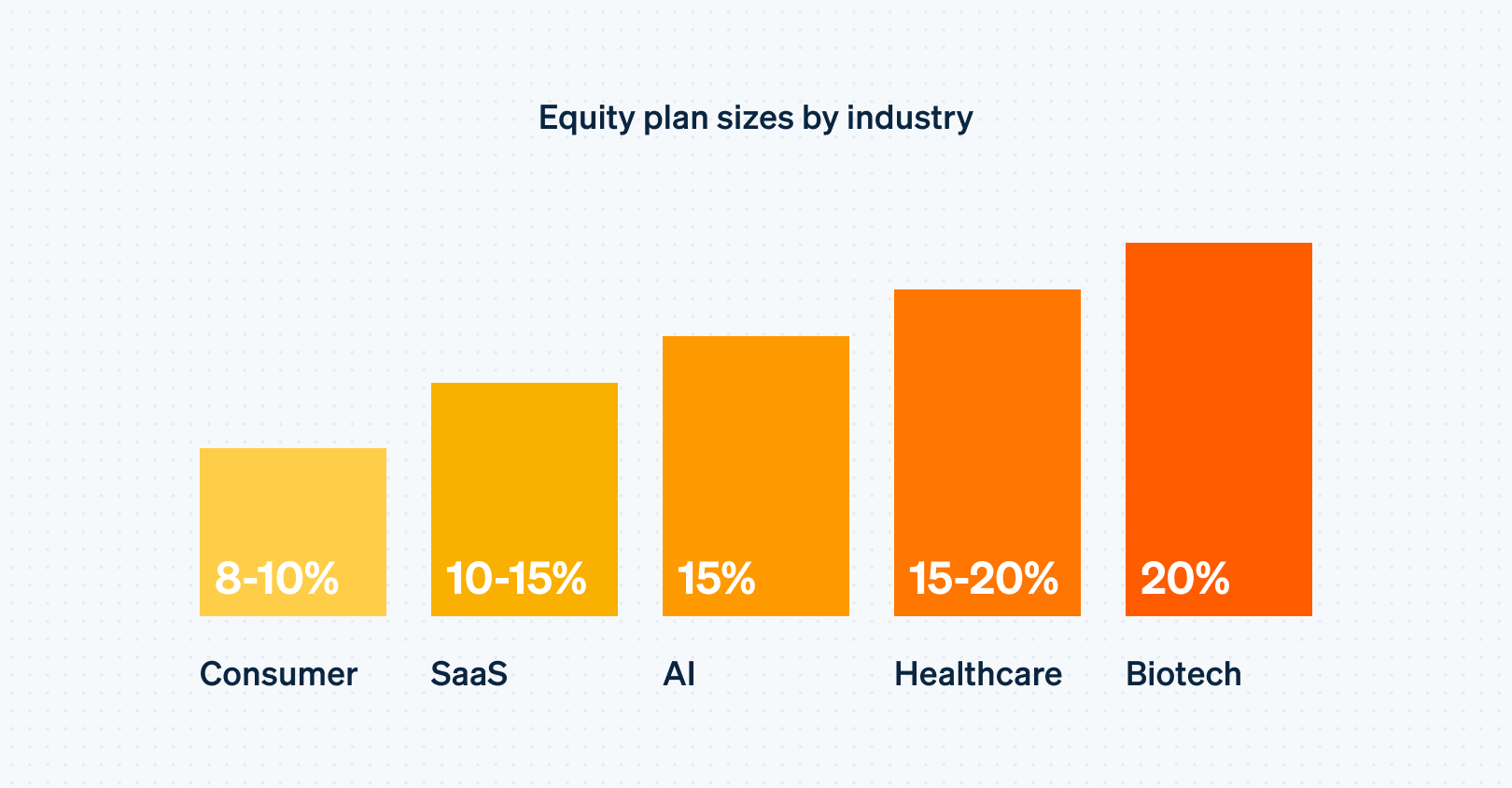

Startups typically create employee equity plans that comprise ten–twenty% of the total equity of the company, and the decision of how big to make the plan within that range depends entirely on your hiring needs. Founders are often coached into picking an arbitrary number in that range, simply being more thoughtful most the number and how it can touch on your cap table will save you an authoritative headache.

The general logic is that the more skilled an employee base you need, the more equity you should set aside. If your startup is building rocket ships (in authenticity—not 🚀), you probably demand rocket scientists and engineers that are in very short supply and will demand a lot in compensation.

At Pulley, we haven't seen nonfounder early employees receive more than than 5% of a company, no affair how skilled or important, and nosotros haven't seen important hires (like a kickoff designer or rocket ship engineer) at early-stage companies dip below 0.3%.

As a new company, y'all can't pay potent salaries that an established multibillion-dollar business volition pay, and you'll need to compensate employees in equity to remain competitive in the hiring procedure.

Conversely, at your early stage, you probable don't accept the fourth dimension or resources to flesh out a fully fledged hiring program or even have a reasonable idea of how much equity some of your key hires will await. Here are a few benchmarks that we've gathered at Caster for equity plans sizes, based on industry:

Keep in mind that what yous should exist aiming for is setting aside enough of an equity plan to become to your next financing round. When yous raise money from investors, they will negotiate how large your employee equity plan should exist once they complete their investment. Similar to when y'all created your equity plan right after incorporation, any equity given to employees will dilute the disinterestedness that everyone else in the company holds. Investors, of grade, desire to own as much as they are able to and volition work to maintain a delicate residual: giving yous a competitive edge in hiring while making sure to not dilute their investment.

How should an employee equity programme handle employee departures or terminations?

The next determination to make inside your equity program is on the ready of rules governing what happens when an employee leaves the company. With resignation rates increasing, and unduly in the engineering industry, this has become an even more of import decision.

The legal terms for these rules are known equally "post-termination exercise periods," and, over the years, startups and their lawyers accept had differing views on the all-time outcome. The goal of these time periods—whether ninety days or x years, for example—is to give an opportunity to employees to gather the greenbacks needed to exercise their options. Otherwise departing employees forfeit unexercised options back to the equity pool and so that they tin can be used by other employees.

It's ultimately a question of fairness. How much time should a visitor allow its employees to gather cash needed to do, while non allowing too much time for employees to sit and wait to encounter if the visitor succeeds? Traditionally, these time periods have been 30–ninety days to marshal with IRS regulations that change the tax condition of certain options ninety days later termination.

More than recently, startups have been split in three directions: (ane) the traditional thirty–90 day window, (2) a longer 10-twelvemonth window, and (3) a variable window depending on employee tenure. For case, some companies add an extra month to do for every month worked. Coinbase and Pinterest have given a seven-yr window to employees whose tenure exceeds ii years.

Short windows crave employees to take greenbacks on mitt to practice almost immediately afterwards quitting their task. Depending on how expensive exercising options volition be, non every employee volition have enough greenbacks to pay for them on 30 or ninety days' notice. This tin create fairness bug. Some employees may be wealthy (and liquid) or be able to tap family or friends; some may be early in their engineering careers and non have tens of thousands of dollars in their checking account.

Conversely, a 10-year window means that an employee can hold onto their options and wait a decade to run across if your company succeeds. The employee will have more than enough time to get together the cash to pay for their options, but this benefit comes at the expense of your other employees. Models take shown that a 10-year window amounts to lxxx% incremental dilution for existing employees—while ex-employees hold onto their options, companies must expand equity puddle sizes to make space for new hires. This aligning solves for one dimension of the fairness problem, merely creates an outsized benefit for departing employees instead.

A variable window—where the fourth dimension period to do extends with tenure at a company—is less regressive than a 10-year window, but information technology presents the same problem. In that location will nevertheless be some employees that can concur options for an outsized period of time. For example, companies may tie do windows to vesting, where employees receive an extra calendar month to practise for every month worked. In this scenario, employees that quit later on a year have the opportunity to wait another full year before exercising, which is a relatively long time to sit on the sidelines and even so benefit from the growth of an early-stage startup.

Years ago, big public companies like Coinbase, Pinterest, and Square inverse from a traditional 90-mean solar day window to a ninety-solar day window that increases to seven years subsequently an employee works for two years. Although these companies ready the tone for how later-stage tech companies address option exercising, it is largely moot now—none of these companies event options frequently, but instead offer Restricted Stock Units, a particular blazon of equity award popular for companies at later stages (typically Series C, D, and beyond).

Unfortunately, a one-size-fits-all solution for post-termination practise periods is not feasible because each employee's financial situation is dissimilar. The simplest solution is to stick to a 30–90 day window for every employee, and make exceptions to the dominion—which have to exist canonical past the board—for special scenarios where the employee needs more than time to get together cash to exercise options.

Your aim should always be to maintain fairness—employees who quit shouldn't gain a particular benefit over those who stay. For Coinbase, Pinterest, and Square, fairness meant rewarding employees who worked for at to the lowest degree two years. For a midstage startup with a large population of employees with lower salaries (such equally a services firm with a high number of junior staff), fairness might hateful a month to exercise for every month worked. And for a i-yr-onetime startup, fairness might hateful keeping practice windows narrow to make the all-time decision for existing employees.

The proposed 30–90 day window with flexibility to extend tin create a minor authoritative headache because extensions typically must be canonical by the board, but information technology is ultimately the fairest issue for folks at early on-stage startups considering: (1) existing employees can take comfort knowing that former employees property options won't dilute their equity, (2) former employees are forced to brand a determination with a financial hardship exception as needed, and (3) you equally a founder can reinforce trust across the organization.

How and when should employees vest their disinterestedness?

The adjacent major decision when granting equity to employees is vesting: deciding under which system employees will receive their equity over time.

For vesting, in that location are three goals:

-

Competitiveness in hiring

-

Fairness when employees quit early

-

Motivating and retaining talent

Competitive Vesting

Vesting is a competitive advantage in hiring. Companies that vest employee equity early create an incentive for employees to bring together past reducing the hazard of leaving or getting fired before an equity grant vests.

For example, large tech companies similar Lyft have moved to a 1-year vesting schedule to speed up employee disinterestedness payouts. While this is bonny for public companies because they can pitch quicker liquidity to prospective hires, there are downsides to speeding up vesting. Accelerating vesting for employees typically means smaller grant sizes and a huge administration burden. Instead of a large grant that vests over four years, companies adopting a i-twelvemonth vesting schedule volition have to decide and execute on a smaller grant each twelvemonth.

At the early stage, getting fancy with vesting is more endeavour than it'due south worth because the burden is on a founder to explain why they are doing something nonstandard during the hiring process. An exception to this dominion is senior management roles. If you are calculation a C-suite role, such every bit a COO, CFO, or co-founder, spending time to offer candidates a bespoke vesting schedule can pay off. Remember of spending your fourth dimension hither on a sliding scale: spend more time and energy (and dig into vesting) with disquisitional candidates.

For the vast bulk of employees at the vast majority of startups, there's a great benefit to standardizing or following the pack. Call up that equity is only effective as compensation if the person receiving it fully understands how information technology works and why information technology could be a meaningful function of their compensation. Startup employees generally know how 4-year vesting with a one-yr cliff works, and minimizing the variables to their agreement of their compensation parcel is important in helping them realize the true value of your company's equity.

Employees who quit early

Another consideration with vesting is to calibrate treatment of an employee who leaves apace. Allowing an employee to gain the benefit of everyone else'due south piece of work in the company even if they only stayed for two months is unfair to the residuum of your team.

This scenario led to the creation of a vesting "cliff," which ways that an employee doesn't vest until they have worked for a certain amount of fourth dimension, typically one year. For a iv-yr vesting schedule, this means 25% of an employee's equity vests at the one-twelvemonth marking.

Startups accept remained remarkably consequent on one-yr cliffs, and employees in the hiring marketplace understand that startup disinterestedness comes with that commitment. For special cases, like a top employee leaving at the 11-month marking to get-go their own company, you can accelerate their vesting on a example-by-case footing to assistance them reach their cliff if necessary.

Use your discretion as the leader of a young company. There's a lot of flexibility in equity grants. Start with the generic standard, then aggressively leverage your discretion to become the all-time upshot for each employee. This is a unique advantage for early-stage companies in a competitive hiring market place. Every bit you scale, this dialogue will naturally shift depending on the needs of your company and employee base of operations, but it'southward critical to start off by setting the right tone with equity compensation.

Motivating and retaining talent

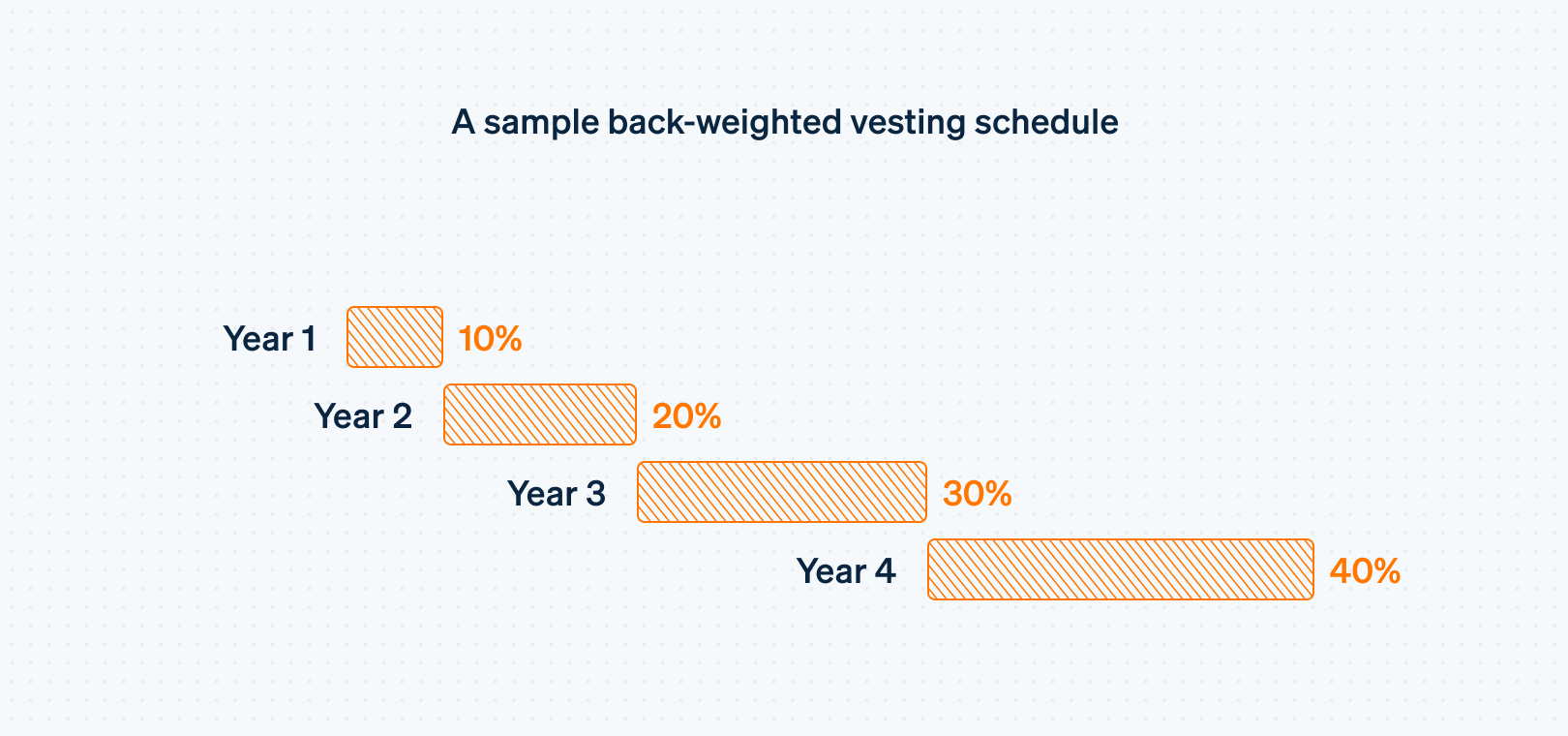

Vesting is as well designed to continue incentivizing employees to piece of work hard. The traditional iv-twelvemonth vesting schedule gives an employee 25% of their grant each twelvemonth, effectively incentivizing them to the same degree throughout their four-yr vesting menstruation. The counter-argument to the traditional schedule is that when employees are often most knowledgeable and empowered—in years iii and four—there isn't any added motivation for them to work harder than in their get-go ii years.

To solve this trouble, companies like Amazon and Snapchat accept started back-weighting their vesting schedule, which means that the employee vests proportionately more of their equity in later years. For example:

Although this solves the problem of motivating employees appropriately, it falls brusque equally a recruiting tactic. Past year two in a traditional iv-twelvemonth vesting schedule, an employee will vest 50% of their equity, while employees vest just 30% in the back-weighted vesting schedule.

For young startups, this is a nonstarter for prospective hires because there's no guarantee that the startup volition not get sold within that time flow, in which case the employee loses out on their unvested equity. Large companies like Amazon or Snapchat do not acquit that aforementioned gamble considering they are publicly traded with liquid equity.

The simplest manner to solve this problem at the early stage is to continue granting equity to employees who take loftier potential or are performing well. Instead of 1 grant at hire, give acme employees additional grants every six to twelve months so that they vest multiple grants at the aforementioned fourth dimension. This approach increases the amount of disinterestedness high performers vest every year, while maintaining your hiring border.

This vesting schedule is also the almost practical answer. Yous tin can't be sure which employees will be the best when you're recruiting, and rewarding performance is a better motivator than rewarding someone for a great interview or resume.

What ways tin can startups grant equity?

There are two ways a immature company can grant equity: stock or stock options. Stock is direct ownership in the company, whereas stock options give an employee the choice to buy stock in the company.

In both cases, your employees will really receive equity over fourth dimension depending on their vesting schedule, only with stock, the employee is treated as "owning" disinterestedness immediately, for tax purposes. In contrast, with options, the employee does non accept any tax consequences until they decide to exercise.

The practical difference for an employee is that, with stock, they will accept to pay taxes for the stock as they belong information technology, while options don't require any upfront investment and requite employees a selection of whether or non to invest in the company by exercising options.

Stock comes with two authoritative hassles. The first is helping employees file an 83(b) ballot with the IRS—this filing reduces the employee's revenue enhancement burden by assuasive them to pay taxes up forepart at a presumably lower charge per unit than if they paid every bit the stock vests and gains value over time. The second administrative burden is buying stock back from an employee when they leave the visitor before they vest.

An 83(b) election is complicated but vital considering the revenue enhancement savings are material to the employee. Stock is but worth granting over options in large part because of the 83(b) election, and missing the 30-day deadline volition result in a worse outcome for your employee than giving them options. Say an employee is granted 48,000 shares of stock, with each share worth $1. If a 83(b) is filed, the employee pays taxes on that $48,000 today—about $16,000 in taxes. If a 83(b) is not filed, the employee pays taxes every time they belong, at the cost of the stock when information technology vests. Then while a share might be $i today, information technology may be $5 in a yr and $10 in two years. The employee is paying taxes as they vest, so the college the price, the more they pay in taxes.

Additionally, when an employee leaves the company, their unvested options are automatically canceled, only if a company grants stock, it needs to buy the stock back from the employee. This isn't hard, just requires an extra bit of paperwork and administrative oversight that a startup wouldn't otherwise have to handle.

The simple heuristic to decide which is all-time for an employee is to consider how expensive the stock volition be to buy: when the cost per share multiplied by the number of shares is more than than $5,000–$x,000, virtually companies switch to options. This typically happens after you fundraise for the first time.

A note about options

Although options are typically easier to administrate than stock, at that place are two areas in which founders often brand suboptimal choices for their employees: (i) choosing the blazon of option that will lead to the best tax result for an employee and, relatedly, (2) whether to let an employee to exercise unvested options.

Both of these rely on agreement how stock options are typically taxed. When an employee exercises an option (with an exception covered below), they are taxed at the departure between the current stock cost of the company and the price they paid for their stock.

For case, if an employee exercises one,000 options for $1 each (totaling $ane,000) and the current stock price is $10 (making the stock worth $10,000), the employee will exist taxed on $9,000 at their ordinary income tax rate.

Additionally, when the company is sold or goes public and the employee sells their stock, the employee volition once more be taxed on the investment gains from owning this stock. Following the example above, if the stock price increases to $100 and the employee sells, then the employee volition owe taxes on the difference between their entry bespeak ($x) and exit ($100). If the employee has held onto their stock for greater than ane year, they will be taxed at the applicative long-term majuscule gains rate, otherwise they'll exist taxed at their ordinary income tax charge per unit.

What's the difference between ISOs and NSOs?

When granting an choice, a company must decide whether to grant an "incentive stock option" (ISO) or "non-qualified stock pick" (NSO). NSOs are traditional stock options and are taxed as described above.

A benefit of ISOs and NSOs is that they both qualify for long-term upper-case letter gains if the employee has held stock for one year and information technology has been two years from the time they received their selection grant. ISOs have a second benefit. They are non taxable upon exercise whereas NSOs, by contrast, are taxed at the ordinary income tax rate upon exercise on the difference between the exercise price and the off-white market value (FMV) of the underlying shares.

Because the benefit is so substantial, the IRS imposes a limit on the number of ISOs an employee may receive: this is equal to $100,000 worth of options that are exercisable in a single year. If this dominion is violated, and then the backlog amount of ISOs are automatically treated as NSOs for tax purposes.

Founders oft make this mistake with early executives by granting them options with a vesting schedule that naturally violates the $100,000 rule. For example, if a founder wanted to give an early hire $300,000 of stock options that vest over four years, they might think that since the grant vests over four years, that but $75,000 is exercisable and therefore under the $100,000 rule. That might exist true, but is often non. Consider the post-obit:

-

January one: Executive is granted 300,000 options with a $i strike price with a four-twelvemonth vesting schedule and a one-year cliff.

-

January 1, the post-obit year: The executive's start 25% of her equity—or 75,000 options—vest and is exercisable (totaling $75,000).

-

On the offset solar day of every calendar month after: six,250 options vest and become exercisable (totaling $6,250 each month).

-

May 1, of that year: 100,000 options will accept vested and get exercisable for the tax year. This means that any additional options vested in the taxation year would automatically be classified as NSOs instead of ISOs.

Timing is everything here considering the IRS works off tax years—and employees with large grants can chop-chop get in trouble even with the almost well-intentioned founders. This problem compounds with the activation of "early exercising."

What is early exercising?

Traditionally, startup employees tin can only exercise vested options. However, an increasing number of startups allow employees to exercise unvested options—commonly known as "early exercising."

At first blush, early on exercising can seem similar a win for employees: the earlier employees exercise, the sooner their stock will exist subject to upper-case letter gains handling at an exit result—and the lower the divergence between the stock price and strike price, the lower the tax liability.

If an employee exercises NSOs when the stock cost is equal to the strike price, they will not pay taxes at all, giving them the same benefit every bit an ISO—if an employee exercises speedily.

The trouble with this strategy is that it forces employees to risk a lot of cash very early on in their tenure at a company to accrue a do good—often earlier they accept whatever information to make a decision on the likelihood that the company will succeed. In addition, because the entire grant tin be exercisable the 24-hour interval it is granted, whatsoever grant that is greater than $100,000 (even if information technology vests over four years) will automatically break the ISO rule and the excess will be treated like an NSO.

Early exercising is favorable to bullish employees who have sufficient funds to practice their options comfortably; it is unfavorable to employees with lower risk tolerance or liquid wealth. If employees are bullish on their company, then they likely don't demand the benefit of exercising early on to stay motivated to piece of work difficult at the company. They already believe in the company's growth prospects.

The recommended solution is to tailor early exercising on a per-employee basis to optimize revenue enhancement consequences. A recent college graduate with loans won't be able to exercise his $100,000 grant immediately and might benefit from a typical vesting and exercise schedule over iv years. A senior executive with excess greenbacks might exist completely bought in and desire to optimize her taxes by exercising all of her options ASAP, or she may decide that despite having sufficient greenbacks, she isn't quite gear up to commit the cash to exercise options and would rather maintain the benefits of an ISO.

Final thoughts on employee disinterestedness

Equity bounty tin can be very challenging for founders because of its legal and revenue enhancement complexities, both of which need mastering to convey to employees. Founders must educate themselves and their employees, who volition almost never understand the mechanics equally well as a founder might, merely who will notwithstanding be utterly dependent on them in the example that the visitor is successful.

The goal of equity compensation every bit a organisation is to be off-white and feel fair to anybody involved. Cash compensation is predictable: it's a number that'due south simple to understand and manage. Equity compensation is mysterious. Employees must estimate how much information technology's really worth after accounting for taxes, which is a complicated and irresolute adding. With equity, a founder'southward single best human activity is to ensure that employees are not getting cheated out of the compensation that was promised to them. Do right by your employees and they'll do right by you.

Drawing from thousands of companies nosotros've helped with equity plans, here is our distilled set of recommendations for an early on-stage startup, from incorporation through its Series A. These can and volition vary as you calibration, but this starting point volition offer you all of the tools you lot need to make the right decision for the nigh important prepare of people to your business organisation: your primeval employees.

Pre-funding

-

Grant stock to employees and ensure they complete their 83(b) elections inside a tight, 30-day window .

-

Stick to traditional four-year vesting with a i-year cliff because expending the fourth dimension and energy to get artistic is non a mission critical task at this stage.

Post-funding

-

Grant options.

-

Stick to traditional four-yr vesting with a ane-yr cliff to remain fair and limit questions during the recruiting process.

-

For employees with an selection grant that is worth greater than $100,000:

- Ask employees whether they want to exercise early.

- If they accept, grant NSOs and make sure employees actually practice.

- If they decline, grant ISOs and work with counsel to tailor the vesting or practise schedule to ensure compliance with the $100,000 rule.

-

For employees with an selection grant that is worth less than $100,000:

- Ask employees whether they want to exercise early.

- If they accept, grant NSOs and make sure employees actually exercise.

- If they reject, grant ISOs.

Almost startups volition find success following this formula, but yous will run into larger companies pushing the boundaries on types of equity packages they are providing to employees, such equally offer a loan in connectedness with stock instead of options or implementing a one-year vesting schedule. Stay firm. Most of the innovation in this space starts at the late-stage or public-company level, because those companies have enough resource to justify the administrative overhead. As your company grows, you'll exist in a position to be more innovative and forward-looking on employee compensation.

Utilize this guide to aid ground best practices early on, but also to frame the financial and administrative tradeoffs that you'll have to make for your employees equally you scale. If you need boosted, hands-on back up, try Pulley. Yous tin can schedule a time with one of our cap table experts if you want to learn more than nearly how to manage your employee disinterestedness more effectively.

This guide is non intended to and does not constitute legal or tax advice, recommendations, mediation or counseling nether any circumstance. This guide and your utilize thereof does not create an attorney-client relationship with Stripe or Pulley. The guide solely represents the thoughts of the author and is neither endorsed past nor does information technology necessarily reflect Stripe's belief. Stripe does not warrant or guarantee the accurateness, completeness, adequacy or currency of the information in the guide. You should seek the advice of a competent attorney or accountant licensed to practise in your jurisdiction for advice on your particular problem.

Source: https://stripe.com/guides/equity-for-employees

Posted by: jamesgrele1966.blogspot.com

0 Response to "How Do Employyes Of A Public Company Make Money Through Equity"

Post a Comment